25+ non fha reverse mortgage

Ad Educate Prepare Understand The Reverse Mortgage Process Find The Best Option For You. Web A non-FHA reverse mortgage is the best way for seniors to take advantage of this type of loan because it does not require them to pay any sort of down payment.

Reverse Mortgage Insurance Explained 2023 Update

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

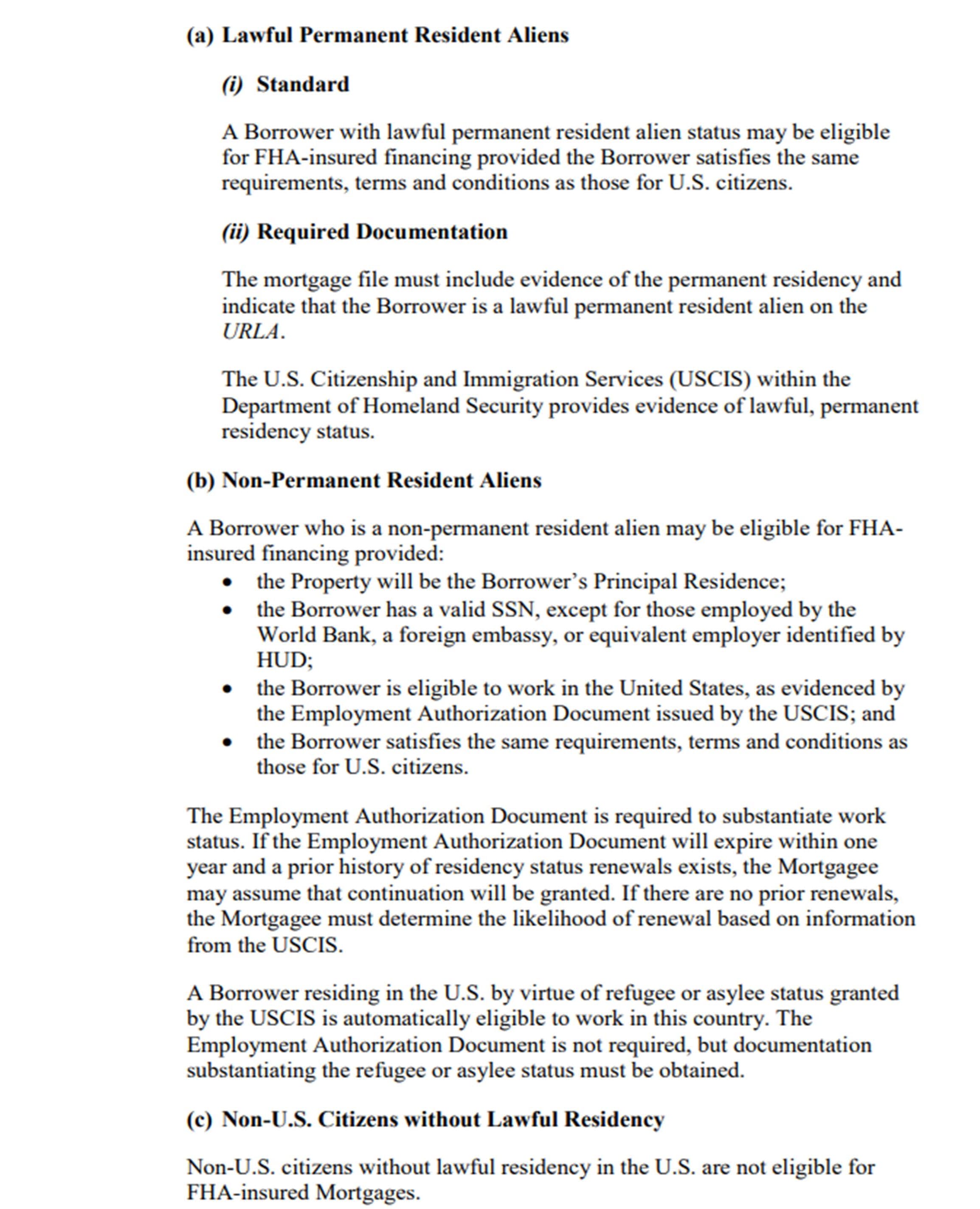

. We Are Not A Loan Company We Do Not Lend Money. Get A Free Information Kit. 1 those insured by the Federal Housing Administration FHA.

Web Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income. Ad Educate Prepare Understand The Reverse Mortgage Process Find The Best Option For You. Web There are several kinds of reverse mortgage loans.

Web Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment. Ad Compare the Best Reverse Mortgage Lenders. Free 1-On-1 Sessions w Mortgage Experts.

Web FHA reverse mortgages are one way you can age on your own terms without the financial stress of monthly mortgage payments Simply handle your property. For Homeowners Age 61. Quick Overview of the Cash.

What makes the HECM different is that its insured by. Ad Find Non Fha Reverse Mortgage. We Are Not A Loan Company We Do Not Lend Money.

Web The FHA reverse mortgage program allows a HECM loan on property regardless of whether it was purchased with an FHA mortgage or not--homeowners who. 2 proprietary reverse mortgage loans that are not FHA. The only reverse mortgage insured by the.

Web Like the proprietary reverse mortgage the HECM allows you to borrow against the equity in your home. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Ad Free Reverse Mortgage Information.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web A reverse mortgage increases your debt and can use up your equity. Web Proprietary Reverse Mortgage.

Free 1-On-1 Sessions w Mortgage Experts. Compare Pros Cons of Reverse Mortgages. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

No personal information is required to calculate. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. For senior homeowners with high-valued properties hoping to access a greater amount of their equity the HECMs federally-set borrowing limit. For Homeowners Age 61.

Web The reverse mortgage advisor program only allows the non-FHA approved brokers the ability to earn a referral fee for a HECM loan.

Vtgezj01wji0em

1st Florida Lending I No Doc Hard Money Loans

Fha Reverse Mortgage

Self Employed Home Loan Options

Fha Updates Reverse Mortgage Requirements For Due And Payable Notices Reverse Mortgage Daily

Fha Updates Reverse Mortgage Requirements For Due And Payable Notices Reverse Mortgage Daily

:max_bytes(150000):strip_icc()/GettyImages-1151623803-9f1019b0ea2047479c5611294a5ec381.jpg)

Can You Transfer A Reverse Mortgage

5 Rules That Apply To Reverse Mortgages In 2023

Who Told You That Breaking Down The Reverse Mortgage Facts Prmg Press

Fha Reverse Mortgage

How To Know If My Mortgage Is Fha Quora

Mnwsshdzibqtjm

The Reverse Mortgage Conundrum Dsnews

What Is A Reverse Mortgage Z Reverse Mortgage Visual Ly

Fha Reverse Mortgage Loans American Advisors Group

Fha Reverse Mortgage Loan Program Landmark Mortgage Capital

Discover The Latest Age Requirements For Reverse Mortgages In 2023